The commercial property industry has, in the main, greeted the release of the latest Property Council of Australia Office Market Report with cautious optimism according to Chris Johnson CEO MMJ Real Estate.

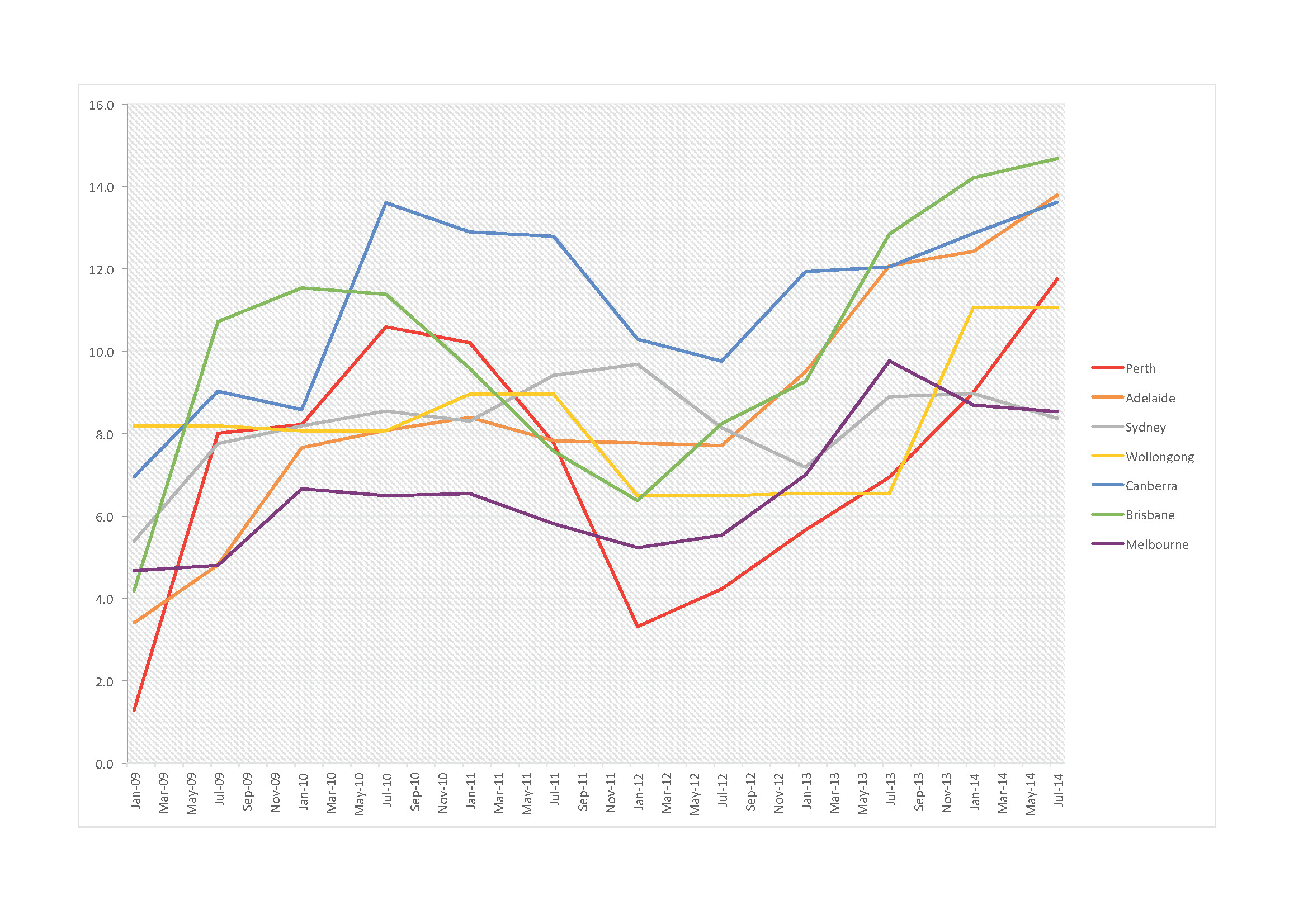

Whilst the overall vacancy rate across all Australian commercial locations showed a modest increase to 10.6%, compared with 10.4% at the start of the year, vacancy rates for Sydney and Melbourne decreased over the period. The change in vacancy rates for the capital cities across Australia and their comparison with January 2014 is as follows:

| Vacancy, Jul 14 (%) | Change | |

| Adelaide | 13.8 | up from 12.4% |

| Brisbane | 14.7 | up from 14.2% |

| Canberra | 13.6 | up from 12.9% |

| Melbourne | 8.5 | down from 8.7% |

| Perth | 11.8 | up from 9.0% |

| Sydney | 8.4 | down from 9.0% |

Johnson confirms demand was positive across the Sydney and Melbourne CBD leasing markets and indicates signs of life for strong growth following improved economic conditions. While Perth Adelaide Brisbane and Canberra saw a rise in their overall vacancy, a contributing factor was increases in the C & D Grade markets.

Good quality stock continues to prove popular across all locations with the improved economic conditions a major factor in the strength of these markets. However, lower C & D Grade property continues to struggle across the nation as tenants seek better quality facilities.

Historical Vacancy Rate % CBD

Perth

A slow down in the resources section, has weakened demand in the Perth Market, which has resulted in its highest office vacancy rate in almost 10 years.

MMJ Real Estate Perth Director, Brad Carey said “Whilst the market has corrected downwards substantially already in Perth, the outlook is for some further softening in the latter half of 2014 and into 2015.”

“ Despite this, leasing deals are being done.”

“Those owners achieving a result are spending regular money on marketing, setting realistic asking rentals reflective of the true market conditions, spending money on presentation and reflecting capital expenditure needs by way of offering relevant incentives.”

Canberra

Office vacancies increased in Canberra to 13.6 per cent. MMJ Real Estate Canberra Director Nick George said “Vacancy levels are a reflection of the Commonwealth Government’s policies on staff numbers and a shift to better quality accommodation.”

“Increases in C and D Grade vacancies and a decrease in A and B suggests that tenants are taking advantage of the soft market to improve the quality of their accommodation.”

“As a result of the Government policies the expected new supply over the next few years is quite subdued compared to the past 5-6 years. This may well impact on construction employment in the ACT unless there is an offsetting increase in major capital works and residential construction. We note that the Local Government is implementing measure to try to facilitate this.”

Sydney

Sydney has been the best performing CBD market with vacancies falling from 9% in January to 8.4%. “Mainly due to resurges of office demand by financial services post mining boom.” Says MMJ Sydney Director Cameron Algie.

“One concern is that in the pipeline developers will add over 400,000sqm ( or 8.5% of the space of the market ) within the next few years.

Wollongong

This report does not reflect updated half yearly figures for the Wollongong CBD, however, MMJ Wollongong Director Michael Croghan reports. “Within the last 6 months in particular there has been a noted increase in leasing activity in the Wollongong market for better grade space.”

MMJ can report on 7 separate deals either concluded or ‘in progress’ in the range of 500 – 1,200m2 , totaling approximately 5,000m2.

Given the spike in vacancy noted in January this year due to the ATO’s recent relocation to new premises and consequent ‘back fill’ of 5,500m2, this is a very pleasing and positive result for what is a smaller regional market.”

The Report also shows the suburban office market is facing fewer vacancies than CBDs for the first time since 2001, with tenant demand on the rise. Suburban vacancies fell from 10.6 per cent to 10.4 per cent in the past six months

Quick Facts

Overall Vacancy Up

the national vacancy rate increased from 10.4 per cent to 10.6 per cent.

Sydney & Melbourne buck the trend.

these CBD markets both recorded positive demand and vacancy decreases.

Challenges ahead for resource cities

supply projections for the Brisbane and Perth CBD markets remain high.